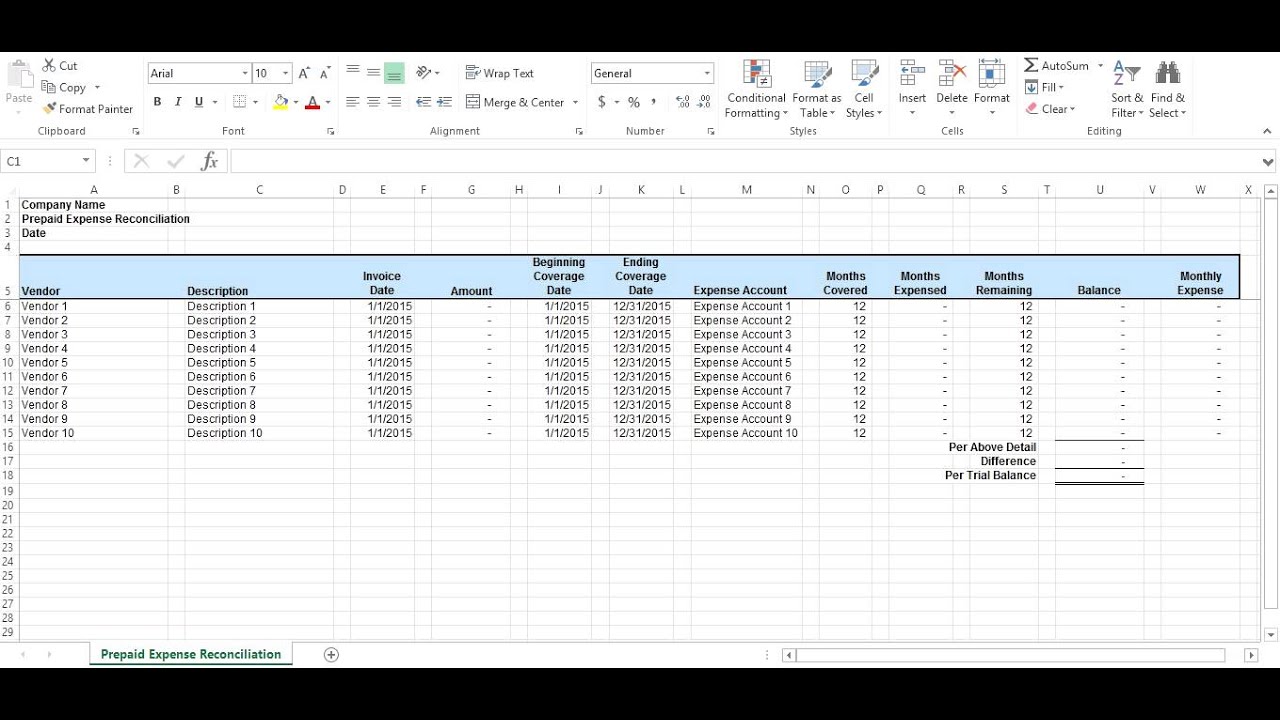

See the section “General Workpaper Functionality and Tips for Entering Data” for further information concerning the effects of rollforward and clear workbook functionality. However, all inputs for the entire workbook can be cleared by selecting the Clear worksheets button on the Summary worksheet. Each transaction is completely different. A prepaid expense is paid first and expensed. (However, when the Clear worksheets button is clicked, any modified line item captions will be deleted.) Each input worksheet includes a Clear worksheets button that will clear all inputs for that particular worksheet. Prepaid expenses refer to advance payments for business expenses, while debts owed by a company in the course of its trade are called accounts payable. A prepaid expense is an expense that has been paid for before it is incurred, and that is treated as an asset. Please note that when the worksheet is "rolled forward" the line item captions describing the individual prepaid expenses on each input worksheet will not be deleted. Thus, the user will only have to fill in the “additions” and “amortization” data for the new Current Year. This function deletes the data from the oldest year (Five Years Ago) and moves the other years of data back one year for each input worksheet.

This can be accomplished by clicking the Rollforward to next year button. As each year passes, the data entered should be “rolled forward” so that it always covers the most recent 5-year period.

Prepaid expenses are held on the balance sheet as an asset until the University receives or benefits from the goods or services then it is recognized as an incurred expense. Use the workbook to carry forward the data from year to year to develop a historical summary for comparison purposes. prepaid expense occurs when the University makes advanced payments for goods or services to be received or benefited from in the future.

0 kommentar(er)

0 kommentar(er)